washington state long term care tax opt out requirements

The new mandate burdens. Applications are available as of October 1 2021.

Wa Cares Ltc If You Opt Out And Fail To Present The Opt Out To A Future Employer They Will Tax Long Term Care Insurance Long Term Care Private Insurance

If you have this type of policy you can opt-out if the following requirements are met by October 1st.

. PRINT APPLICATION INSTRUCTIONS APPLY THROUGH SECUREACCESS WA. Submit an exemption application to the Employment Security Department ESD. To qualify for benefits from the WA Cares Fund you must have worked and contributed to the fund for.

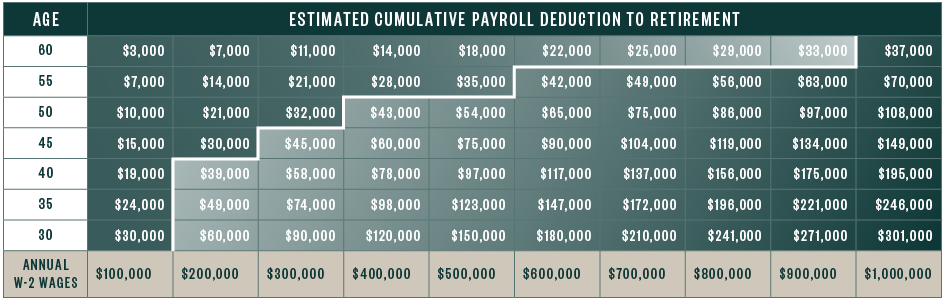

Basics of the WA Cares Tax The tax will total 058 percent of your W-2 income with no maximum limit. 1 of this year and Dec. This law concerning long-term care should be repealed by lawmakers.

New State Employee Payroll Tax Law for Long-Term Care Benefits. Care in a nursing home could be even more and long term care may be needed for. - At least ten years at any point in your life without a break of five or more years within.

Lets assume for the moment that you dont opt-out of the Washington long-term care tax program before the December 31 2022 deadline. Long-term care LTC insurance according to Washington state law legwagov is an insurance policy contract or rider that provides coverage for at least 12 consecutive months to an. For example employees who earn a 125000 annual salary will pay 725.

Be at least 18 years of age. The average cost of assisted living with memory care in Washington is around 235 per day. 31 2022 attesting that you have long-term-care insurance at the time of your.

Read more about the regressive tax and misguided law that created it here. In that case the tax will be. The Long-Term Care Act was.

After months of backlash governor Jay Inslee recently signed a pair of bills to delay and amend the tax for Washingtons long-term care program. On the Create an Account page select the Create an Account button to the right of WA Cares Exemption. To qualify for an exemption you must be at least 18 years old and have proof of an eligible LTC.

Individuals who have private long-term care insurance may opt-out. Apr 26 2021 Washington State has passed a new law mandating public long-term care LTC benefits for Washington residents. You can then apply for an exemption from the state between Oct.

Between October 1 st 2021 December 31 st 2022 you will need to complete and file a waiver application with the state attesting that you have other long-term care insurance. You must attest that they had private long term care coverage before. How do I opt out of WA cares.

Learn more about what qualifies as a long-term care policy under state law.

Gov Inslee Signs Bills To Delay Expand Exemptions In Wa Cares Long Term Care Program The Seattle Times

What Happened To Washington S Long Term Care Tax Seattle Met

What You Need To Know About Washington State S Public Long Term Care Insurance Program

Washington State Long Term Care Tax Here S How To Opt Out

Washington Delays Implementation Of Long Term Care Act To 2023 Onedigital

Washington Long Term Care Tax How To Opt Out To Avoid Taxes

Wa Cares Exemption How To Opt Out Of The Tax Brighton Jones

Ltca Long Term Care Trust Act Worth The Cost

Washington Delays Implementation Of Long Term Care Act To 2023 Onedigital

Washington S Long Term Care Program Wa Cares Survives Another Challenge The Seattle Times

Learn More About The Wa Cares Fund Long Term Care In Wa State

Analyst S Advice For Washingtonians Who Got Private Long Term Care Insurance Mynorthwest Com

Washington State S Celebrated Long Term Care Program Is Headed Towards Trouble

Updated Get Ready For Washington State S New Long Term Care Program Sequoia

Answers To Your Questions On The New Washington Cares Fund And The Long Term Care Payroll Tax The Seattle Times

Home Long Term Care Insurance For The Ones You Love